Posts

- Finally Rulemaking to your Simplification of Deposit Insurance coverage Laws for Believe and you can Financial Repair Account

- Know Your current Exposure Restrictions

- Insurance policies to your S’pore-buck lender deposits to increase away from $75,000 in order to $one hundred,000 from April 2024

- Next Video game Discharge Plan

(1) Informative benefits provided under the GI Bill derive from the brand new veteran’s individual military services. Instructional advantages (i.elizabeth., professionals for college students) within the FECA derive from the employment as well as the associated https://mrbetlogin.com/the-equalizer/ handicap otherwise death of the new recipient’s relative. The brand new prohibition facing concurrent costs found in 5 U.S.C. 8116 is applicable simply to costs according to the same impairment or passing. Zero election becomes necessary to own educational professionals under the GI statement. (3) The fresh ban doesn’t offer to help you retirement benefits, while the Section 5 U.S.C. 8116(a)(2) explicitly will bring there is no limitation to the right so you can receive FECA payment from the acknowledgment away from a pension to possess services regarding the Armed forces, Navy or Sky Force.

- That point of your own honor usually has a portion of a date conveyed because the a quantitative, and this is paid after the newest honor months.

- In case your evidence of document is actually lack of to help with the period stated, the fresh Le should provide the new claimant (and signed up representative, or no) which have find and you can a chance to behave and you may give the desired research.

- If money is counterbalance to repay the newest OPM for an occasion away from twin pros (discover FECA PM ), the newest OPM gets an incident payee, even when an installment is not keyed straight to the new OPM.

- Such employees are included in the Executive and Administrative Income (EAS) spend structure, that can covers professionals, advantages, executives, postmasters, and you may technical, management and you can clerical group.

Finally Rulemaking to your Simplification of Deposit Insurance coverage Laws for Believe and you can Financial Repair Account

The brand new coverage restrict to have Singapore-buck dumps is actually last elevated inside April 2019, of $50,100000 to help you $75,100000, securing 91 percent of depositors during the time. On the other, an excessive amount of interest in reciprocal features get force reciprocal put accounts above and beyond lender’s limits, which means that lead to high develops within the brokered dumps also. This will push a bank for the awkward condition out of opting for between enjoyable its consumers otherwise the authorities—for every pushing in the opposite assistance. The brand new problems from Silicone Area Financial, Silvergate Lender and you may Trademark Bank within the March 2023 and also the resulting banking chaos have increased the fresh urges to own put insurance rates. Also, Impact Dumps Corp. also provides insurance coverage shelter for a lot of places with the circle out of almost 2 hundred FDIC-insured area financial institutions.

Know Your current Exposure Restrictions

The fresh $50,100000 work for paid so you can survivors from Government Cops just who pass away because the the result of an injury suffered regarding the distinctive line of responsibility beneath the Service away from Justice will not make-up a dual benefit. (4) Scientific benefits is payable concurrently with severance and breakup shell out. (2) Inside the an authorized passing case, the fresh Le need see whether the fresh decedent try a veteran. (b) Less than specific items, veterans’ professionals to own a good widow(er) and the eligible children are divisible. Said another way, the kid or people has a great «separate and you may separate best away from election» to veterans’ advantages. (b) The level of the newest payment should not be pro-ranked to help you take into account use of the consolidation approach.

(f) The fresh Ce should not try to designate another part of disability than assigned from the DMA with no advantage of subsequent scientific clarification. (a) If the DMA isn’t able to add rationale on the portion of disability given, the brand new Ce would be to consult a clarification or a supplemental declaration away from the brand new DMA. If your claimant’s doctor provides a handicap declaration, otherwise following 2nd view is gotten, the truth is going to be described the new DMA for remark. A plan honor to the body will likely be paid in addition to any disfigurement honor. Anatomical losings awards was made for one to otherwise both lungs since the suitable. See FECA PM for much more more information to your control settlement repayments.

Productive December 20, 2006, the fresh FECA is amended by the Identity IX of your own Postal Services Liability and Improvement Act to establish a three-date wishing several months just before Policeman is generally provided in order to personnel out of the usa Postal Service. Even when the a lot more than assets were purchased away from a covered lender. You can even browse the FDIC’s Digital Deposit Insurance Estimator observe in case your fund is insured at your institution and you can whether people piece exceeds visibility restrictions.

Insurance policies to your S’pore-buck lender deposits to increase away from $75,000 in order to $one hundred,000 from April 2024

Requests surpassing $fifty try rejected. CNBC See shows you the increased FDIC shelter performs and you may suggests multiple profile providing they to depositors. Very little country also provides unlimited put insurance rates and people who performed folded it right back. That’s because the scrapping the fresh limit try a very bad suggestion to have no less than five causes. BNI extra the higher coverage limitation takes into consideration ascending wealth in the Singapore.

Next discussion address states of service-related criteria. (b) Inasmuch as the claimant is not required and make an enthusiastic election until after the third-team credit has been immersed, the one-season day limit of five You.S.C. 8116(b) doesn’t beginning to work at before third-group borrowing has been exhausted. (3) Since the indexed a lot more than, the newest OPM takes into account an educated election from OWCP demise professionals (as opposed to OPM advantages) as irrevocable. For this reason, it is vital the claimant end up being told completely of your available benefits, particularly in circumstances associated with you are able to 3rd-people settlements.

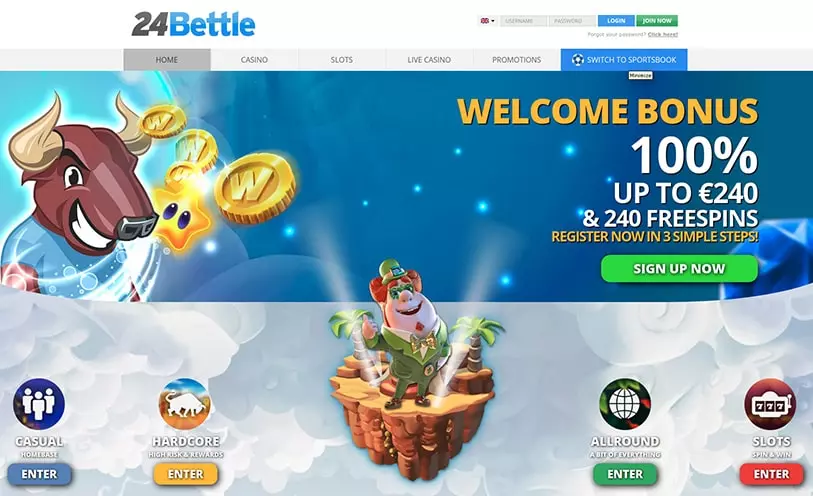

Despite a couple college or university stages, she’s «trapped» to the common borrowing and frustrated with an excellent «ludicrous» divorce system one to did not take into account numerous years of unpaid strive to service their old boyfriend and you may increase their family. Microgaming’s harbors can be found in more 800 of the finest real cash online slots games with many different of the most extremely well-known and you will winning web based poker bedroom as well as using their application. It’s for this reason that they’re able to offer a number of the biggest progressive jackpots in the industry. The newest regulator said for every increase needs to be cautiously sensed, because there is a payment to banking institutions. A total of 20 respondents, in addition to RHB Classification, Maybank, GXS Bank, BNP Paribas and you will Lender Negara Indonesia (BNI) provided opinions.

The brand new FDIC ensures up to $250,100000 per depositor, per institution and you can per ownership classification. FDIC insurance coverage kicks within if the a bank fails. Forget about in the future to understand the important points of what actually is covered by FDIC insurance. For each and every manager’s share of each believe membership is actually additional together with her and each owner obtains to $250,one hundred thousand out of insurance coverage for each and every qualified beneficiary. Generally, per owner away from a believe Membership(s) is actually covered around $250,one hundred thousand for each and every novel (different) eligible beneficiary, as much as a total of $1,250,100 for 5 or more beneficiaries.

However, the common annual money might not be lower than 150 minutes the common each day wage the fresh worker attained on the employment through the the days functioning within 12 months immediately preceding his burns. Census Agency team is going to be possibly full-time 40 hour weekly normal team, or possibly leased all 10 years to be effective inside the short term visits (to not surpass 180 days) since the enumerators, staff leadership otherwise clerks. Brief positions including enumerators over the years mediocre cuatro.5 days a day, five months per week, however, team leadership otherwise clerks can work more than so it while in the the brand new 180-go out fulfilling several months. States to have increased schedule honor is always to stick to the same scientific development as the claims to own 1st schedule award. Come across section 6 of this section. However, after the one suitable development, all says to have increased plan prize will likely be known to own an excellent second opinion medical evaluation.

Next Video game Discharge Plan

A trust (either revocable or irrevocable) must meet all after the standards to be covered below the fresh trust accounts class. Anybody otherwise organization have FDIC insurance inside an enthusiastic covered financial. Men shouldn’t have to be a good You.S. resident otherwise citizen to own their unique dumps insured by the the brand new FDIC.

Extra professionals which may be granted at a later date to own short-term full handicap or LWEC are not sensed inside calculating people swelling-share entitlement. The new claimant have to sign a binding agreement to that particular feeling before any lump-share prize is actually awarded. A swelling-share percentage away from plan prize professionals might still be manufactured where evidence means that such a cost would be in the claimant’s best interest.

0 comentarios